Share information

Swisscom share performance indicators

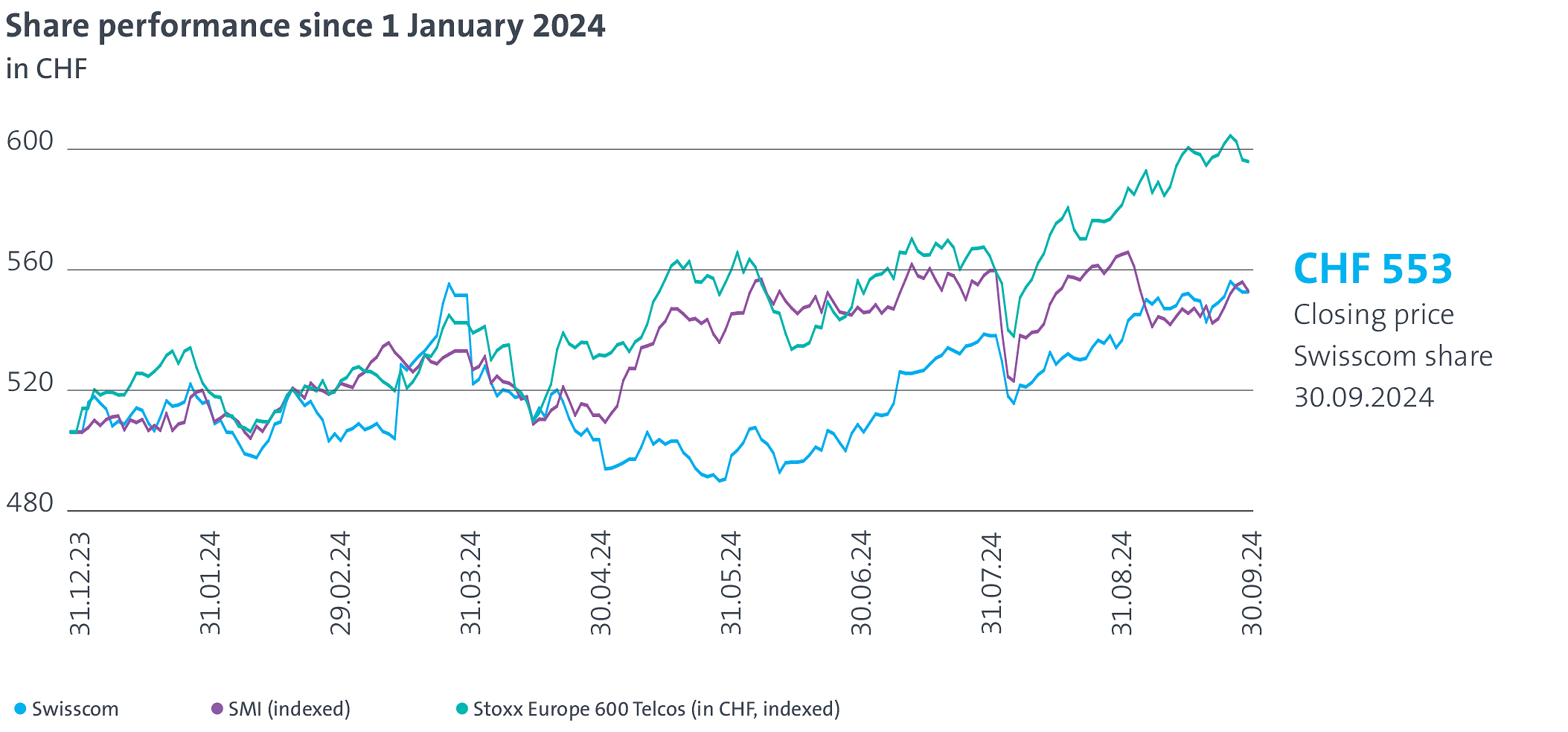

1.01.–30.09.2024 |

SIX Swiss Exchange |

|

|---|---|---|

| Closing price as at 31 December 2023 in CHF 1 | 506.00 | |

| Closing price as at 30 September 2024 in CHF 1 | 552.20 | |

| Year high in CHF 1 | 559.80 | |

| Year low in CHF 1 | 486.80 | |

| Total volume of traded shares | 16,452,518 | |

| Total turnover in CHF million | 8,499.15 | |

| Daily average of traded shares | 87,513 | |

| Daily average in CHF million | 45.21 | |

|

Source: Bloomberg

|

||

|

1 paid prices

|

||

Share performance

Financial calendar

- 13 February 2025 2024 Annual Results and Annual Report

- 08 May 2025 2025 First-Quarter Results

- 07 August 2025 2025 Second-Quarter Results

- 06 November 2025 2025 Third-Quarter Results

Stock exchanges

Swisscom shares are listed on the SIX Swiss Exchange under the symbol SCMN (Securities No. 874251). In the United States, they are traded in the form of American Depositary Receipts (ADR) at a ratio of 1:10 (Over The Counter, Level 1) under the symbol SCMWY (Pink Sheet No. 69769).