Cash flows

| In CHF million | 2020 | 2019 | Change | |||

|---|---|---|---|---|---|---|

| Operating income before depreciation and amortisation (EBITDA) | 4,382 | 4,358 | 24 | |||

| Lease expense | (300) | (294) | (6) | |||

| EBITDA after lease expense (EBITDA AL) | 4,082 | 4,064 | 18 | |||

| Capital expenditure | (2,229) | (2,438) | 209 | |||

| Operating free cash flow proxy | 1,853 | 1,626 | 227 | |||

| Change in net working capital | 140 | 83 | 57 | |||

| Change in defined benefit obligations | 65 | 48 | 17 | |||

| Net interest payments on financial assets and liabilities | (69) | (63) | (6) | |||

| Income taxes paid | (309) | (371) | 62 | |||

| Other operating cash flow | 26 | 22 | 4 | |||

| Free cash flow | 1,706 | 1,345 | 361 | |||

| Dividends paid to equity holders of Swisscom Ltd | (1,140) | (1,140) | – | |||

| Net expenditures for company acquisitions and disposals | (29) | (53) | 24 | |||

| Foreign currency translation adjustments | 8 | 107 | (99) | |||

| Other changes | (5) | (8) | 3 | |||

| Decrease in net debt | 540 | 251 | 289 |

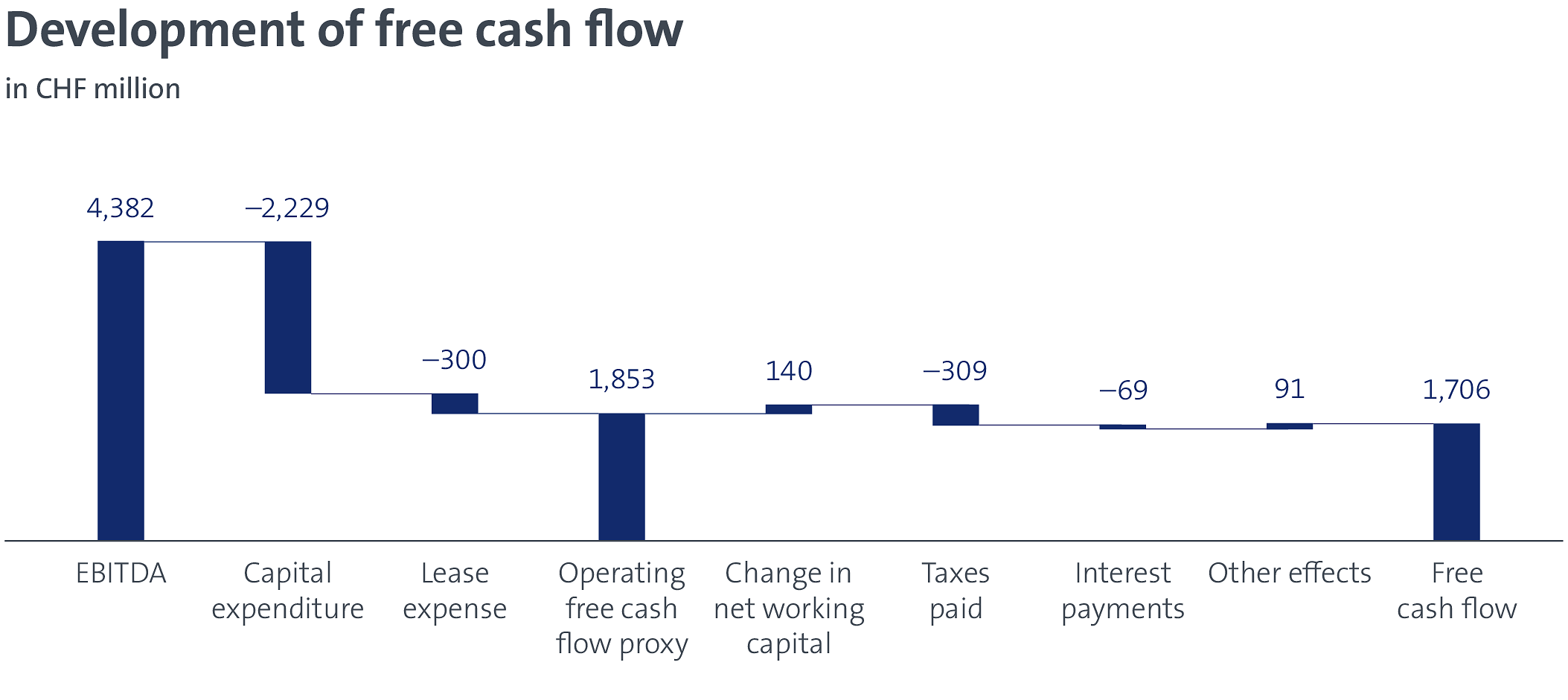

The operating free cash flow proxy increased by CHF 227 million year-on-year to CHF 1,853 million, mainly due to lower capital expenditure. Capital expenditure in the previous year included CHF 196 million for mobile radio frequencies in Switzerland. Excluding this expenditure, the operating free cash flow proxy increased by CHF 31 million or 1.7% as a result of higher operating income before depreciation and amortisation (EBITDA).

Free cash flow increased by CHF 361 million year-on-year to CHF 1,706 million. Adjusted for the expenditure for mobile radio frequencies, free cash flow increased by CHF 165 million. The increase was attributable in part to lower income tax payments of CHF 309 million (prior year: CHF 371 million). Net working capital fell by CHF 140 million compared with the end of 2019 (prior year: decrease of CHF 83 million). In 2020, an unchanged dividend per share of CHF 22 was paid. This corresponds to a total dividend payment of CHF 1,140 million. Overall, net debt decreased by CHF 540 million to CHF 6,218 million.